Open enrollment for health plans effective Jan. 1, 2019, will run from Nov. 1 to Dec. 15, giving consumers the least amount of time to enroll in or renew plans since the Affordable Care Act (ACA) became law. Last year, consumers had an additional week.

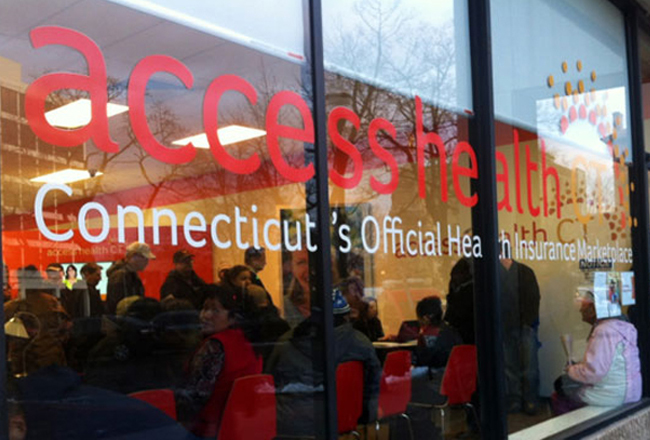

As a result, Access Health CT (AHCT), Connecticut’s health insurance exchange, is broadening its outreach and marketing efforts and, for the first time, giving consumers a sneak peek at plans.

“A lot of people want to see what options they have ahead of open enrollment,” said AHCT Marketing Director Andrea Ravitz. “Every year, we need to remind individuals that they have choices. We want to make sure they have access to as much information as possible to pick the right plan.”

This year’s marketplace offers plans from ConnectiCare and Anthem. Open enrollment is Nov. 1-Dec. 15.

Consumers can browse plans starting today using a special tool at accesshealthct.com. In addition, AHCT is holding a series of events across the state and offering phone, online and in-person assistance to help individuals choose a plan.

The average ACA monthly premium cost was $689 this year, but for 75 percent of enrollees the average subsidy was $600, according to a report from the Centers for Medicare & Medicaid Services.

The marketplace has two insurance carriers, ConnectiCare and Anthem. Many plans offered for 2019 under both carriers will cost more, but in September state regulators drastically reduced the rate hikes both carriers had sought.

Anthem had proposed a 9.1 percent rate increase for 2019 plans, but regulators approved an average premium increase of 2.7 percent. ConnectiCare had sought a 13 percent increase, which was pared down to an average increase of 4 percent.

As in the past, plans are organized into bronze, silver, gold and platinum categories, and consumers should compare plans to see what works best for them. Platinum plans, for instance, typically have higher premiums but lower out-of-pocket costs, whereas bronze plans have the lowest premiums but highest out-of-pocket costs.

No ‘Opt Out’ Fines

One big change consumers will notice for 2019: There will be no financial penalty for opting not to buy insurance.

In previous years, most consumers had to have insurance or face a fine. Those who had no insurance in 2018 will pay either 2.5 percent of their yearly household income or $695 per person ($347.50 per child), whichever is higher, when they file their 2018 tax returns in early 2019.

Ravitz said AHCT conducted focused groups with about 60 individuals to gauge whether the absence of a penalty would impact enrollment trends for 2019.

“The majority said, with or without the tax penalty, it wouldn’t affect their decision,” she said.

The Marketplace

AHCT is the online marketplace created by the ACA, sweeping health care reform legislation that requires most Americans to have health insurance.

During open enrollment, people without coverage can shop for insurance plans and those with coverage can renew or change their plans.

Ravitz said it is too soon to predict how many people will enroll in plans through the exchange this year, but 114,134 did last year, up more than 2 percent from the previous year. Of those, most—about 73 percent—enrolled in plans offered by ConnectiCare.

Various improvements have been made to AHCT’s website, including enhanced live chat capabilities and a new “Compare Plans” link that will let consumers see various plans’ physician networks, prescription coverage, out-of-pocket expenses and other benefits, Ravitz said.

“This is going to allow people to make better, more informed choices,” she said of the comparison tool. While monthly premium costs often play major roles in which plans consumers choose, she added, “We want to make sure people are able to make better decisions rather than just looking at the price tag.”

After open enrollment ends on Dec. 15, consumers can sign up for 2019 coverage only if they have a qualifying life event, such as loss of insurance, marriage or the birth of a child. New this year, pregnancy is now a qualifying life event.

Consumers can apply online, call AHCT at 855-805-4325, get in-person help, or use AHCT’s free mobile app for smartphones or tablets.

While most people have to wait until Nov.1 to enroll in plans, enrollment in Medicaid HUSKY and the Children’s Health Insurance Plan (CHIP) is open year-round to eligible people and families.

AHCT, now in its sixth year, also will open seven enrollment centers statewide in early November where people can receive in-person help, and will host six enrollment fairs. In addition, it will host a traveling series of educational discussions called “Healthy Chats,” during which experts will speak to groups of people about enrollment options as well as answer questions.

Usually, some people—about 15 percent of those who enroll in plans through AHCT—have trouble verifying the income or citizenship information they must submit once the open enrollment period ends, Ravitz said. AHCT is increasing efforts to reach and help those people too, she added.