I have a high regard for Consumer Reports, pay for the monthly magazine and the digital service, and frequently go by its recommendations before buying expensive items. I have published many of its suggestions and warnings.

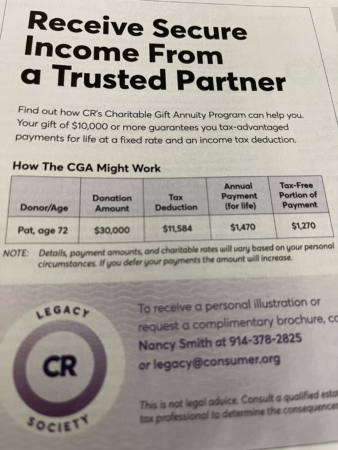

But I was stunned to read in its September magazine an ad asking for readers to make annuity gifts. Consumer Reports doesn’t accept regular advertising and funds its operations through subscriptions and charitable donations.

The ad flatly says that if at the age of 72 you give Consumer Reports $30,000 as a charitable annuity gift, you will receive a one-time tax deduction of $11,584.

That is completely untrue for most Consumer Reports readers.

To be able to claim such a deduction, the donor would have to itemize instead of taking the standard deduction.

The vast majority of Americans take the standard deduction because they do not have enough deductible expenses like real estate tax, mortgage interest of huge medical bills. They are much better off taking the standard deduction, which for a couple aged 72 is $27,400.

If you take the standard deduction, as a couple, you can only take a maximum of $600 in charitable deductions.

Taxfoundation.org estimated that only 5.3 percent of the average taxpayer itemizes. That means that 94.7 percent of taxpayers could at the most only get a portion of the promised $11,584.

Few Americans itemized after the 2018 tax reform act went into effect, which doubled the standard deduction.

The ad also says that the $1,470 annual annuity payments will only result in $200 of taxable income. That would means that $1,270 of income will be tax free for life.

But that is somewhat misleading. The non-taxable income is only valid until the donor reaches a predetermined age – based on the projected life expectancy at the time of the gift. After that age, the donor’s annuity income would be fully taxable.

The ad makes no mention of these facts but in smaller print suggests that potential donors need to “NOTE: Details, payment amounts, and charitable rates will vary based on your personal circumstances” and that those interested “should consult a qualified estate and/ or tax professional to determine the consequences of this gift.”

It also says in larger letters: “Your gift of $10,000 or more guarantees you tax-advantaged payments for life at a fixed rate and an income tax deduction.”

If the Consumer Reports advertising department had shown its ad to a first year tax preparer, they would have been put on notice that it is incorrect and misleading.

The ad is shown right below.

the result of the last “tax cuts”